By: Omar Abd ELHADY

Introduction:

Since 2022, Egypt has found itself entangled in a complex economic web, facing a foreign exchange crisis that has evolved into a severe shortage of US dollars, exacerbating a concurrent government debt and inflation crisis. These crises are intricately interlinked, with the shortage of US dollars influencing the debt repayments and triggering an inflationary spiral. This interconnected economic scenario demands a nuanced approach to find solutions that address each facet while avoiding exacerbation of one crisis in the pursuit of resolving another. In this context, understanding the origins, consequences, and potential remedies for these crises becomes paramount for Egypt’s economic stability and future growth.

FOREIGN EXCHANGE PROBLEM

Since 2022 Egypt has been experiencing a foreign exchange crisis that has culminated in 2024 as a shortage in US dollars. This shortage occurred when the outflows of US dollars from the country for transactions such as the repayment of debt denominated in US dollars exceeds the inflows of US dollar through transactions such as worker remittances. This shortage is represented by the demand for US dollars exceeding the available supply at the current price of the US dollar (the official exchange rate).

Measuring the shortage:

Egypt has been running a current account deficit since 2017/18. In the case of Egypt this deficit means that the inflow of dollars to the country through exports, Suez Canal revenue, worker remittances and other sources of dollar inflow has been less than the outflow of dollars mainly through financing imports. This current account deficit has to be covered somehow, a portion of it is covered by foreigners’ investments in Egypt, either direct investment (FDI) or through portfolio investment (colloquially known as “hot money”) what is not covered by these two items is then covered by drawing down on the Central Bank’s foreign reserves.

Source of the shortage and price increase: The Egyptian economy has experienced starting from 2022 a series of external shocks that increased burden of the Central bank to cover a greater portion of the current account deficit by drawing down on its foreign reserves. These shocks started with the Russian Ukrainian war on Feb, 24, 2022 which played a factor in the exit of “hot money” (i.e., portfolio investments in debt instruments such as Egyptian treasury bills) especially after the Federal Reserve increased interest rates on March 16, 2022. This exit increased the demand for dollars and since this demand could not be fully satisfied by the current account inflows of dollars, the central bank had to draw down on its foreign reserves to cover this increase in demand. Reducing the supply of dollars in the Economy and pushing the price of dollar upwards (the equilibrium exchange rate). However, the shortage is not a direct consequence of this exit rather, the reason behind the shortage is that the central bank has kept the official price of the dollar below the equilibrium market price (parallel market price). As a consequence, the shortage occurred in the official exchange rate market. However, today in 2024 as the official market has not been able to supply the dollars at the stated price, the parallel market has taken over and a pseudo floating of the currency has occurred.

GOVERNMENT DEBT PROBLEM

In tandem and partially as a consequence of the foreign exchange crisis aforementioned a government debt crisis has materialized. In particular, the crisis is heavily attributed to the external debt obligations, the majority of which is made up of debt denominated in US. Dollars. As of the latest Central Bank of Egypt (CBE) external position report around 70% of Egypt’s external debt is denominated in US dollars (112.6 billion US$). On the short term this means the increase in the exchange rate has made the debt service (repayment of principal and interest payments) more expensive in terms of Egyptian pounds. This played a factor in the Central Bank’s decision to fix the exchange rate at around 30 EGP as compared to the parallel market which has a rate that reached 60 EGP as of January 2024. This is so as to not increase the debt burden on the government even more.

The debt crisis at however is mitigated by the fact that the majority of this external debt is not held by commercial entities, rather a majority of it is held by countries and multinational institutions. These entities comprise 70.6% of the external debt (Multinational + Arab + China + Paris Club). As they have historically been lenient at least in comparison to commercial entities when it comes to rescheduling the debt and providing alternatives to default. Nonetheless, the total debt service remains high as debt service in 2024 is $29.23 billion according to the CBE. A large portion of this debt service will have to be financed through government borrowing since the government will be running a deficit of 7.1% of GDP in the FY 2023/2024. To the extent that this borrowing will be financed by money creation this will have a negative effect on the level of inflation.

INFLATION PROBLEM

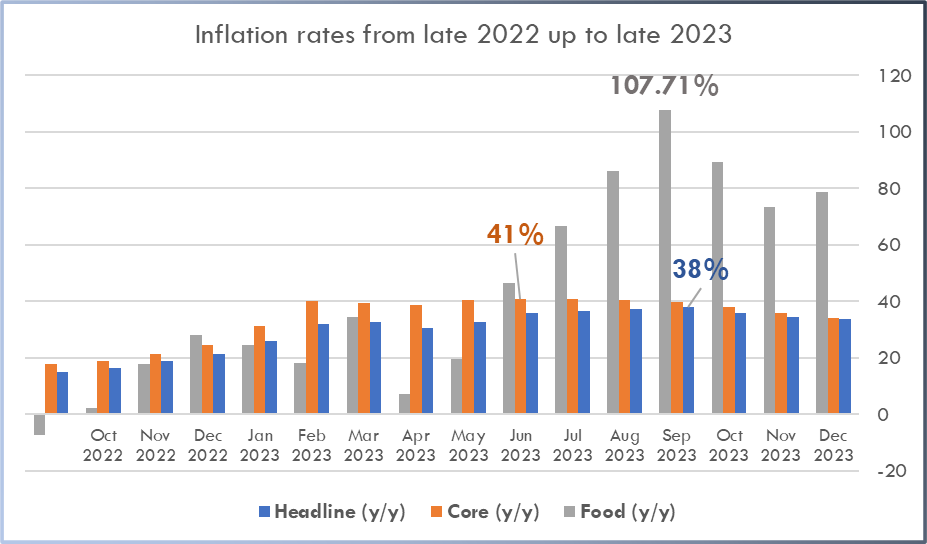

The beginning of the inflation crisis started in late 2022 early 2023. Concurrent with the second devaluation of the Egyptian pound in late 2022. The devaluation led to imported inflation by significantly increasing the costs of imports for both raw materials and final goods in terms of Egyptian pounds. Core inflation reached a maximum of 41% in June of 2023, Headline inflation reached a maximum of 38% in September of 2023 and food inflation reached a maximum of 107.7% in August of 2023. These staggeringly high levels of inflation have eroded much of the purchasing power of the Egyptian population. This hit the lower income classes particularly hard since they typically spend a majority of their income on food and food inflation was the highest during the period.

SOLUTIONS

What will a solution to these problems would look like?

It is important to recognize that there is no single solution that can definitively solve all of the previously mentioned problems together. Rather a most preferred compromise is what is available. Since each of these problems is heavily related to each other, solving one of the problems will in no doubt affect at least one of the other problems and may even heavily exacerbate it.

It is also important to distinguish between short-term and long-term solutions and to identify how they are related to each other.

(1) Solutions to the foreign exchange problem

There are three main ways that the government can eliminate the dollar shortage. Either to float the currency, reduce demand for the dollar or increase the supply of dollars.

(A) Floating the currency

This solution is about bringing the official price of the currency closer to its market price or parallel market price. This will simply involve the Central Bank to stop intervening in the foreign exchange market for the dollar and trade the dollar at its market price. This will immediately solve the shortage problem. The floatation will possibly also exert a downward push on the exchange rate of the dollar as the difference between the official rate and parallel market rate has made worker remittances decrease. So the floatation will increase worker remittances. In addition, many international institutions such as the IMF has put floatation as a requirement for further dollar denominated loans. So, this will also exert a downward pressure on the price of the dollar however it is not known by how much this downward pressure would be able to offset the increase in the price of the dollar.

Side effects on inflation and government debt: The free-floating of the currency will likely involve another round of inflation. However, this round is not expected to be as severe as the second round of inflation in late 2022. This is because at this point due to the shortage of dollars in the official market many industries have already started purchasing their dollars from the parallel market at the equilibrium market price for the dollar. So, this means that the official devaluation to the market price will only affect the portion of the economy that still uses the official exchange rate. Nonetheless, it is expected that there will still be another round of inflation as a result of the floatation. This will aggravate the external debt problem of the government since the cost of repaying dollar denominated loans will increase as a result of the inflation

Implementation time: Immediate

Effect: Permanent effect

Duration: Long-term

(B) Reducing demand on the dollar

Reducing the demand on the dollar will exert a downward pressure on the market price of the dollar bringing it closer to the official exchange rate at which demand and supply would be equal and the shortage would be eliminated.

(B1) Reducing government dollar spending:

The Egyptian government has been spending heavily on national projects in recent years. The 2023/24 budget is set for around to 3 trillion EGP in expenditures compared to only 2 trillion EGP in the previous year. This increase in expenditures will involve increasing the demand for dollars for the government’s projects.

Side effects on inflation and government debt: Reducing government spending will positively affect inflation and will positively affect the government debt problem. Short-term solution

Implementation time: Immediate

Effect: Permanent effect

Duration: Until the problem is alleviated

(B2) Import substitution of final goods:

By producing imported goods domestically this reduced the demand for dollars and the outflow of dollars from the country.

Side effects on inflation and government debt: no effect on debt crisis, may result in reduced imported inflation.

Implementation time: Immediate

Effect: Permanent effect

Duration: Until the problem is alleviated

(B3) Impose import restrictions:

Impose restrictions that decrease the number of imports entering the country. This will also reduce the demand and outflow of dollars as a consequence as with the import substitution solution. However, this solution has a more side effect.

Side effects on inflation and government debt: Will result in cost push inflation as the cost of inputs into production such as raw materials will rise.

Implementation time: Immediate

Effect: Long-term

Duration: Until the problem is alleviated

(C) Increasing supply of dollars

Reducing the supply of the dollar will exert a downward pressure on the market price of the dollar bringing it closer to the official exchange rate at which demand and supply would be equal and the shortage would be eliminated.

(C1) Encouraging exports:

This will increase the inflow of dollars into the country. In addition, it would also reduce the current account deficit which will reduce the burden on the central bank to cover the deficit.

Side effects on inflation and government debt: No significant effect on inflation and government dent.

Implementation time: long time to implement

Effect: Permanent effect

Duration: Permanent

(C2) Selling government assets to foreigners

Side effects on inflation and government debt:

Implementation time: long time to implement

Effect: Permanent effect

Duration: Permanent

(C3) Attracting portfolio investments

Side effects on inflation and government debt:

Implementation time: long time to implement

Effect: Permanent effect

Duration: Permanent

(2) Solutions to the government debt problem

(A) Rescheduling payments of the debt with the creditors

Side effects on foreign exchange and inflation: This will reduce the government’s demand on dollars exerting a downward pressure on the market price. No significant effect on inflation.

Implementation time: Depends on the creditors

Effect: Permanent effect

Duration: Permanent

(B) Increase revenue:

Implementing more taxes

Side effects on foreign exchange and inflation: Will have a downward effect on demand pull inflation by reducing disposable income. No significant effect on foreign exchange.

Implementation time: long time to implement

Effect: Permanent effect

Duration: Permanent

(C) Reduce government spending

Side effects on foreign exchange and inflation: Will reduce demand pull inflation created by the government. No significant effect on foreign exchange.

Implementation time: long time to implement

Effect: Permanent effect

Duration: Permanent

(3) Solutions to the inflation problem

Since the inflation is largely an imported inflation as a result of the devaluation of the pound. Typical monetary policy tools such as raising interest rates are not as effective.

(A) Import substitution of final goods:

By producing imported goods domestically this reduced imported inflation as a result of the currency devaluation.

Side effects on foreign exchange government debt: As mentioned before import substitution will exert downward pressure on the price of the dollar. Through its effect on the exchange rate import substitution will also help to reduce the government debt burden in terms of Egyptian pounds.

Implementation time: long time

Effect: Permanent effect

Duration: Permanent

(C1) Currency Stabilization:

policies to stabilize the exchange rate at the current rate and prevent further devaluation.

Side effects on foreign exchange and government debt: Will cause the shortage of dollars to persists and the government debt burden will not be reduced.

Implementation time: long time to implement

Effect: Short-term effect

Duration: Until a better solution comes about

References

- https://www.cbe.org.eg/en/economic-research/statistics/inflation-rates

- https://www.cbe.org.eg/en/economic-research/time-series/downloadlist?category=97805EA8534C4134B65BDE9621E187AF

- https://www.cbe.org.eg/en/news-publications/news/2023/07/25/12/23/press-release-balance-of-payments-performance-in-the-july-march-of-fy-2022-2023

- https://www.bloomberg.com/news/articles/2022-11-10/egypt-reveals-16-billion-funding-gap-that-imf-deal-can-help-fix

- https://egyptianstreets.com/2023/05/10/egp-3-trillion-expenditures-2-1-tn-revenues-in-23-24-budget-finance-minister/

- https://www.shorouknews.com/news/view.aspx?cdate=09052023&id=62bdc6da-fcef-4768-8373-bf1fc1b0ffa5

- https://english.ahram.org.eg/NewsContent/3/12/509507/Business/Economy/Egypt-required-to-pay–bln-in-external-debt-in–CB.aspx